Following “Category Management – 1 The Basics”, is the next important part of Catman.

3. Process of Category Management (key reference from MBM and Oracle)

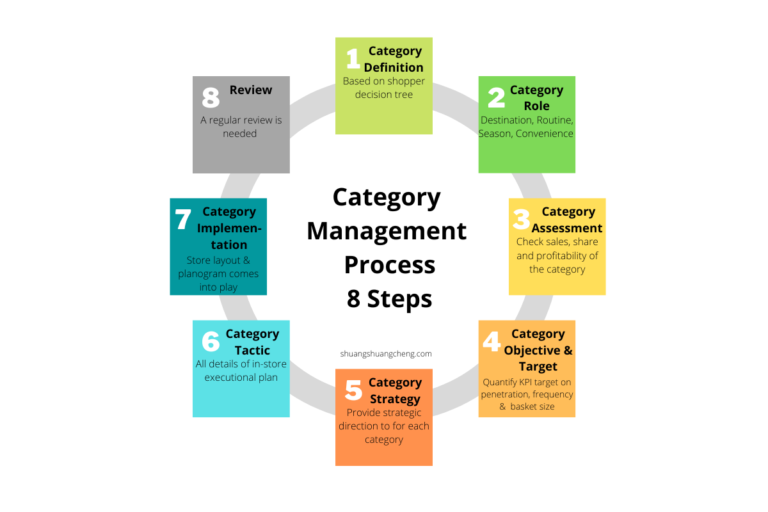

You cannot skip the 8-step process when you talk about Category Management.

It’s essentially a model to follow when you run any proper Catman. It is a work process a Category Manager should repeat along the way. However, except the first time, I don’t think it’s necessary to run the entire cycle too frequently, instead, could focus on the stages of category assessment, strategy and tactics.

1). Category Definition

Based on shopper decision tree (a thought process shopper takes when they make decision in buying staff), it could be occasions (meals in the weekends) first, shopper mission (grab and go lunch today), events (Christmas, Valentine’s) first, etc.

May have subcategories.

The assortment planning, store layout and shelf display should follow this, unless it’s not logistically possible. For example fresh milk and long shelf life milk.

If category definition is existing already, should use this step to review the definition based on retailer and supplier strategy.

2). Category Role

Outline the role that each category plays in the retail/supplier.

Once this is set up, should also prioritise resources based on the importance of each category.

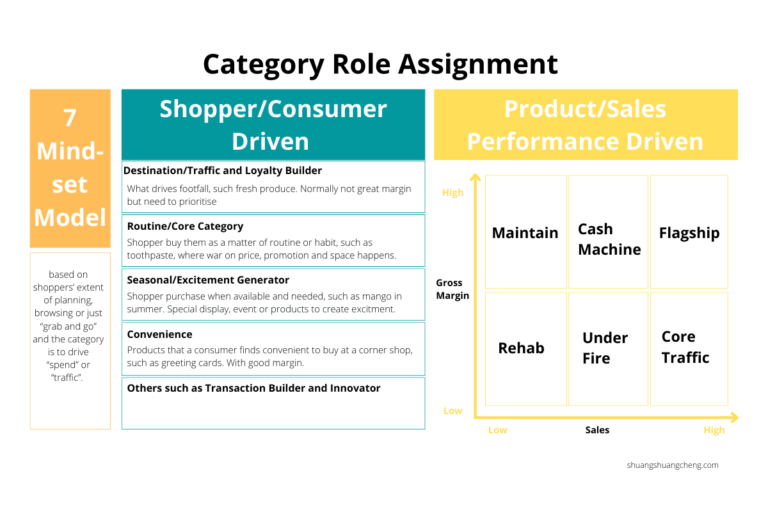

There are mainly 2 models of Category Role Assignment, a) shopper/consumer driven, and b) product/sales performance driven. In today’s consumer oriented market, I think the first would be the best, but it’s definitely worth to look at categories from a different perspective.

Shopper Intelligence also created a comprehensive The 7 Mindsets Model which based on shoppers’ extent of planning, browsing or just “grab and go” and the category is to drive “spend” or “traffic”. They have listed priority strategies for each role, which is very good for planning of promotion. More details can be found here.

a) Shopper/Consumer Driven Role Assignment

Destination Category/Traffic and Loyalty Builder:

To retailer: what drives footfall. For example, many people go to M&S for its high quality of fresh products and own label food, (M&S was voted for UK’s favourite in-store supermarket by Which? Feb 2022, they received 5 star for store appearance and quality of its own-brand and fresh products).

This category normally don’t have great margin, but it’s a destination category that retailer has to devote enough resources to bring along traffic and loyalty.

To brand: This logic should apply to brand’s category management, which should be aligned with retailer, but has its unique stand considering brand’s strategy and priority. Think which product is bringing people to your brand.

Routine/Core Category:

To retailer: shopper buy them as a matter of routine or habit, almost mandatory. Examples include toothpaste, soaps, etc..

They usually accounts for 50-70% of the categories and are where war on price, promotion and space happens. This category should have higher margin than destination category.

To brand: are those products shopper have it in their regular purchase.

Seasonal Category/Excitement Generator:

To retailer: this includes products which are not purchased very often or are purchased when available and needed. Examples would include mangoes sold in summer, flowers on Mother’s Day, and they could also fall into Core Categories.

This will dictate space, price and promotion. Create great event, promotion, displays, or products to generate excitement, and revenue could also come along with emotional purchase.

To brand: similar approach. And need to make sure such products are ready before the actual season for listing and stocking, and come up with great activation to drive the momentum.

Convenience Category:

To retailer: These are products that a consumer finds convenient to buy at a corner shop, they are most likely not on a routine shopping list but shopper finds them convenient to add to the order. Examples include products like shoe polish and greeting cards.

They don’t usually have big space or promotions and are in general with great margin. This is also where customer satisfaction could generate as it help reinforce the retailer as the full-service store of choice.

To brand: same apply.

There could be other segments, such as Transaction Builder that are temporary or supplementary products, customer would buy extra on top of original order, or upgrade their current choice. Think limited edition. And Innovator whose key role is really to create excitement and drive impulse buy.

b) Product/Sales Performance Driven Role Assignment

Flagship category is identified by high sales and high gross margin. Should consider introducing more products or creating new sub-categories, emphasising more profitable SKUs, increasing service levels, and so on.

Cash Machine category is represented by high sales and medium gross margin. Should consider increasing assortments, pruning less profitable SKUs, and introducing private label.

Maintain categoryis identified by low sales and high gross margin. Should consider promoting profitably, emphasising high-profit SKUs, and increasing the assortment in growing categories/sub-categories.

Core Traffic category is represented by high sales and low gross margin. Shoulder considering creating private label in high and low quality tiers, and matching competition.

Under Fire category has medium sales and low gross margin. Should consider delisting a number of sub-categories and/or SKUs and retaining the more profitable ones.

Rehab is characterised by low sales and low gross margin. Should consider axing a number of sub-categories and/or SKUs and retaining only the most profitable ones.

Of course with the development stages/strategies of the business, the approach could vary.

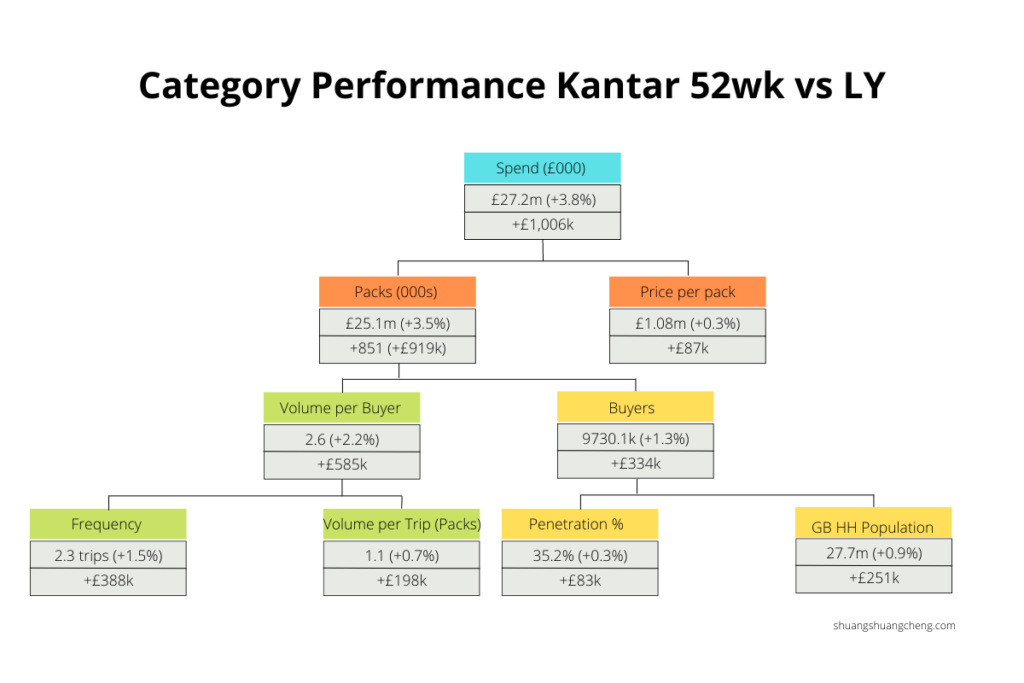

3) Category Assessment

Review of the category from retailer sales and customer data, to check sales, share and profitability of the category.

This assessment should include your competitors.

Check market trends and changes as well, in case needs for re-categorisation.

Remember the key is to generate insights, not to be trapped by all the data on hand. To get useful insights, could try to identify hypotheses first.

An example below of one perspective to do category assessment, can compare category performance (e.g. ambient oriental) vs. subcategory (e.g. soy sauce) vs. brand for supplier to see if they are over or under trade. As a supplier, don’t forget to check the source of your new shoppers, are they from switching from other brands, or new category shoppers.

4) Category Objective and Target (scorecard)

Quantify a mutual KPI target determined by the assessment result, and specify the project length and due date. The information should be tracked in a Category Scorecard. The target should be on the following (and this goes back to the revenue equation)

– Penetration: more new customers

– Frequency: existing customers to buy more often

– Basket size: increase average spend on each visit

5) Category Strategy

Provide strategic direction to for each category to execute tactics, and ensure consistency among roles, objectives and tactics. Strategy examples:

Traffic Building Strategy: attract shoppers to the store.

Turf Protecting Strategy:e.g. price lock products to compete with Lidl and Aldi.

Transaction Building Strategy:to enlarge the size of the average purchase, for example multipacks, larger packs and promotion.

Profit Generating Strategy: high margin, less price sensitive. Private Brands.

Excitement Generating Strategy:Often by innovation, or tapping into a relevant and current social trend. Typically, this falls into the ‘Seasonal Category.’ At times, this can also fall into ‘Core Categories.’ For example, ‘named’ cans of Coca-Cola or limited edition of chocolate bars.

Cash Generating Strategy:The focus here is on large volume, high turnover categories.

Image Enhancing Strategy: Those that improve the overall image and engender loyalty. For instance, presentation and delivery.

6) Category Tactic

Discuss and confirm all details of in-store executional plan in terms of assortment, pricing, promotion, space, and inventory, based on the category strategy and target. For example, you don’t want to plan the promotion for all the products in the same category.

7) Category Implementation

This is where the store layout and planogram (POG) comes into play.

Store layout is focusing on the overall retail space design encompassing all 5 senses, not my area but very interesting subject combining data analysis and psychology. It should also reflect the category roles and strategy. Still remember some basic rules learnt back in my time in Beijing, such as

fresh products, with its freshness and bright colours, at the entrance to make good first impression and make people feel good

bakery near the entrance to bring footfall with its fragrance, or at the very end of the store so people have to navigate through many other products

slow done the shopper journey to encouraging discovery and browsing through special display, education, amenities

check out at front left following general traffic flow (start from right, leave on the left)

never overlook store background music (still remember the time when Tony, our Retail Innovation Centre director spent time selecting piece by piece store background music with us and explaining the reasons behind)

“The planogram is a computer-developed diagram showing retailers where and how to display category products at individual stores. It is, in fact, the embodiment of Category Planning and is the most effective method for executing the plan in-store. It ensures the correct mix of products, with the correct adjacencies, are implemented.” Source: MBM

This job is usually done by Merchandising Team with a role of maximise the return on shelf space and create the best shopping experience, essentially, from shoppers’ perspective, the planogram needs to

Ensure all my products are available

My products are easy to find

Remind me of what I’ve forgotten

Inspire me to try something better or new to me

Products are the right price and my total spend is not a shock source: IGD

And based on this, there are few essential elements a good planogram must consider

– Right assortment

– Where to place the product

– How many facing

– Good navigation through display of products and shelf signage

– Adjacency according to shopper decision tree and category role

– NPD and education to infuse excitement and inspire people

– Promotion to offer best price and increase footfall

– POSM for highlighting promotion, education, and attract attention

The best way to measure effectiveness of planogram is to correlate the layout with epos data (could consider colour coding products according to its sales performance on the planograms to better visualise), and to find out

Space vs. Sales – measure and compare the % share of space, value & volume of each SKU and the category

Best seller and where is it

Hot and cold part of the planogram

High converting product/shelf (consider number of facing)

Slow moving product/shelf

Promotion effectiveness

POS effectiveness

Below lists some basic rules for planogram, of course they are not absolutely right in certain occasions, we should always be agile.

– High volume products (despite not yielding the highest profit) should be put on the eye-level as they are normally traffic builder

– High margin products should be put next to traffic builder

– Put high converting products with slow moving could drive sales

– Place complementary products next to routine products for upsell

– NPD and those with extensive marketing support from other platform should be put in a central position

8) Review

Make sure the whole project runs smoothly toward the mutual goal. And this require regular review.

To measure the success of Catman, could look at below areas

If the market share has grown

If the shopper satisfaction has grown

If the sales and margin have improved

If cost has been reduced

In the next blog, I will be talking about Range Review and Role of Category Manager.

Latest Blogs

Covid has changed the entire humanity. Amid all the negatives from hos...

我新认识了一个好朋友。 到了这个年纪,认识一个新的好朋友很不容易。 因为是爸爸朋友的孩子,又是高中校友,我们知道彼此超过20年,但也只是3年...

Following “Category Management – 1 The Basics”, is t...

As originated from retail business, Category Management (Catman) was s...